Average Net Earnings:

$$2\cdot(Emy) + 2\cdot(Em - 80m - 2Emy + 160my)+ (4Emy - 2Em - 2Ey + E)$$

$$ = 320my+2Emy-2Ey-160m+E$$

$$ = (160+E)2my-2Ey-160m+E$$

Note that \$80 is subtracted from the entire expected earnings, as that is what you pay to initially choose.

Thus the average net earnings to you (loss to Monty) for each play of this game is now $(160+E)2my-2Ey-160m+E-80$

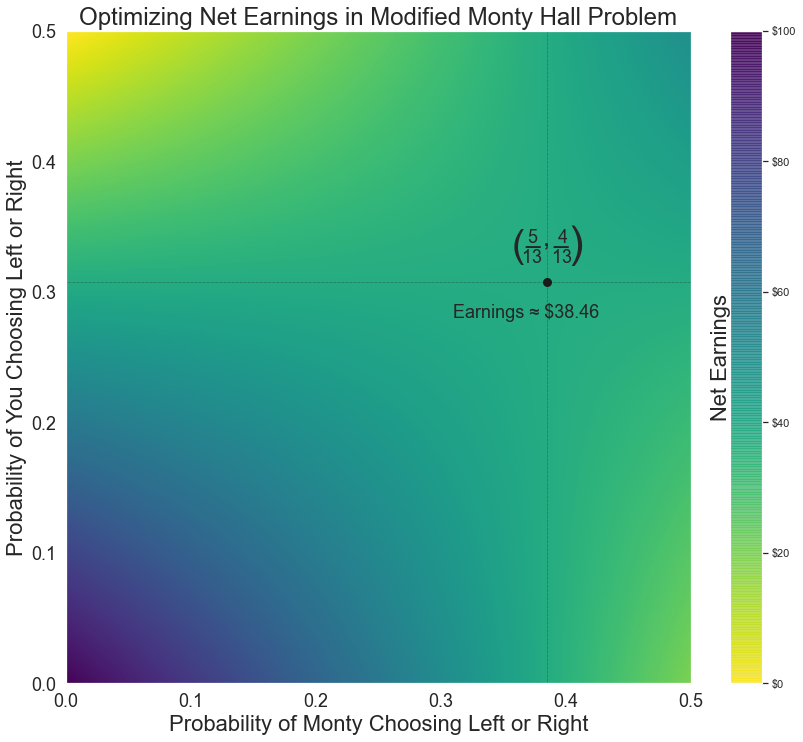

Similar to above, we will determine the probabilities for the Nash Equilibrium, but then use them to find the minimum value of $E$ to make the earnings positive for you.

Monty's Optimum Strategy:¶

For some value you $m$, you will always receive $-160m + E - 80$. However, $320my+2Emy-2Ey$ should remain unchanged. This occurs when $m = \frac{E}{160+E}$.

Your Optimum Strategy:¶

For some value you $y$, you will always receive $-2Ey + E - 80$. However, $320my+2Emy-160m$ should remain unchanged. This occurs when $y = \frac{80}{160+E}$.

Minimum Earnings Necessary:¶

Substituting the above values of $m$ and $y$,

$$0 < \left(160+E\right)\cdot 2 \cdot \left(\dfrac{E}{160+E}\cdot\dfrac{80}{160+E}\right) - \left(2E\cdot\dfrac{80}{160+E}\right) - \left(160\cdot\dfrac{E}{160+E}\right) + \left(E-80\right)$$

$$0 < \dfrac{160E}{160+E} - \dfrac{160E}{160+E} - \dfrac{160E}{160+E} + \left(E-80\right)$$

$$0 < -160E +\left(E-80\right)(E+160)$$

$$0 < -160E + E^2 +160E - 12800$$

$$12800 < E^2$$

$$E > \sqrt{12800} \approx 113.14$$

There must be at least \$113.14 prize money to make the game worthwhile to you.